38 present value of a zero coupon bond

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. ... Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate. Coupon Rate - Learn How Coupon Rate Affects Bond Pricing A zero-coupon bond is a bond without coupons, and its coupon rate is 0%. The issuer only pays an amount equal to the face value of the bond at the maturity date. Instead of paying interest, the issuer sells the bond at a price less than the face value at any time before the maturity date. ... As a simple example, consider a zero-coupon bond ...

How to Calculate PV of a Different Bond Type With Excel A. Zero Coupon Bonds . Let's say we have a zero coupon bond ... The present value of such a bond results in an outflow from the purchaser of the bond of -$794.83. Therefore, such a bond costs $794 ...

Present value of a zero coupon bond

Advantages and Risks of Zero Coupon Treasury Bonds Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be purchased for far less than half of that amount. Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year. Bond Pricing - Formula, How to Calculate a Bond's Price For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value. Each bond must come with a par value that is repaid at maturity. Without the ...

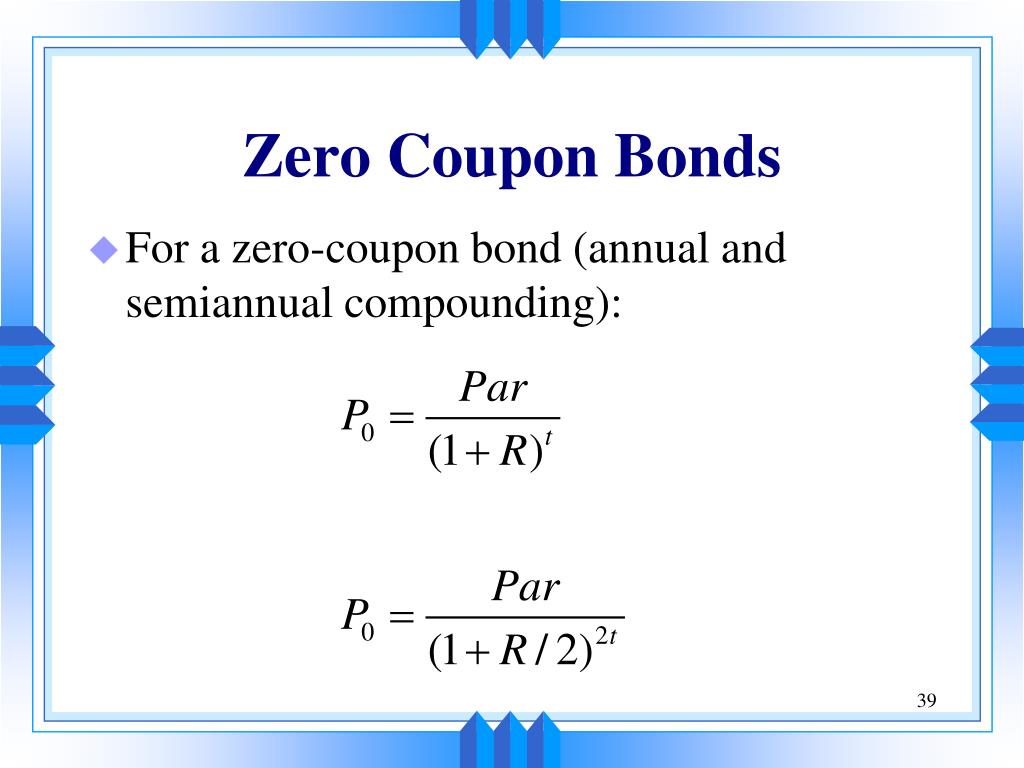

Present value of a zero coupon bond. Zero-Coupon Bond Definition - Investopedia Zero-Coupon Bond: A zero-coupon bond is a debt security that doesn't pay interest (a coupon) but is traded at a deep discount, rendering profit at maturity when the bond is redeemed for its full ... Zero Coupon Bond: Definition, Formula & Example - Study.com The basic method for calculating a zero coupon bond's price is a simplification of the present value (PV) formula. The formula is price = M / (1 + i )^ n where: M = maturity value or face value. i ... Zero coupon bond definition — AccountingTools What is a Zero Coupon Bond? A zero coupon bond is a bond with no stated interest rate. Investors purchase these bonds at a considerable discount to their face value in order to earn an effective interest rate. An example of a zero coupon bond is a U.S. savings bond. Zero-Coupon Swap Definition - Investopedia Zero Coupon Swap: A zero coupon swap is an exchange of income streams in which the stream of floating interest-rate payments is made periodically, as it would be in a plain vanilla swap , but the ...

How to calculate the present value of a bond - AccountingTools Go to a present value of $1 table and locate the present value of the bond's face amount. In this case, the present value factor for something payable in five years at a 6% interest rate is 0.7473. Therefore, the present value of the face value of the bond is $74,730, which is calculated as $100,000 multiplied by the 0.7473 present value factor. Bond Valuation Definition - Investopedia Bond valuation is a technique for determining the theoretical fair value of a particular bond. Bond valuation includes calculating the present value of the bond's future interest payments, also ... Bond Price Calculator | Formula | Chart coupon per period = face value * coupon rate / frequency. As this is an annual bond, the frequency = 1. And the coupon for Bond A is: ($1,000 * 5%) / 1 = $50. Determine the years to maturity. The n is the number of years it takes from the current moment to when the bond matures. The n for Bond A is 10 years. Determine the yield to maturity (YTM). How to Calculate Yield to Maturity of a Zero-Coupon Bond Consider a $1,000 zero-coupon bond that has two years until maturity. The bond is currently valued at $925, the price at which it could be purchased today. The formula would look as follows ...

Zero Coupon Bond | Definition, Formula & Examples - Study.com Based on the calculated present value of the coupon rate and the present value of the face value, the total price of the coupon bond is $47.84 + $942.60 = $990.44 Zero-Coupon Bond vs Coupon Bond: How do I Calculate Zero Coupon Bond Yield? (with picture) The zero coupon bond yield is easier to calculate because there are fewer components in the present value equation. It is given by Price = (Face value)/ (1 + y) n, where n is the number of periods before the bond matures. This means that you can solve the equation directly instead of using guess and check. The yield is thus given by y = (Face ... Calculating the cost basis on a tax free Zero Coupon Bond "Changing" the interest rate on a zero coupon bond, by definition, involves changing it's present value, or price. If in your example you have no intention of restating at the purchase price of your bond and your entry price is still 50% of par, then your yield to maturity has to be 3.4%. The only way the yield to maturity used for your cost ... How Can a Bond Have a Negative Yield? - Investopedia It has a face value of $1,000 and interest payments of $8 per year. In this scenario, the bond table will show that the bond will have a YTM of about 10.86%. If the bondholder had paid $1,200 for ...

Bond Valuation | Meaning, Methods, Present Value, Example | eFM Unusual patterns may be a result of the different types of bonds, such as zero-coupon bonds, in which there are no coupon payments. Considering such factors, it is important for an analyst to estimate accurate cash flow for the purpose of bond valuation. ... Thus, Present Value of Bond = 9.25+8.57+7.94+80.85 = US$ 106.62. There are other ...

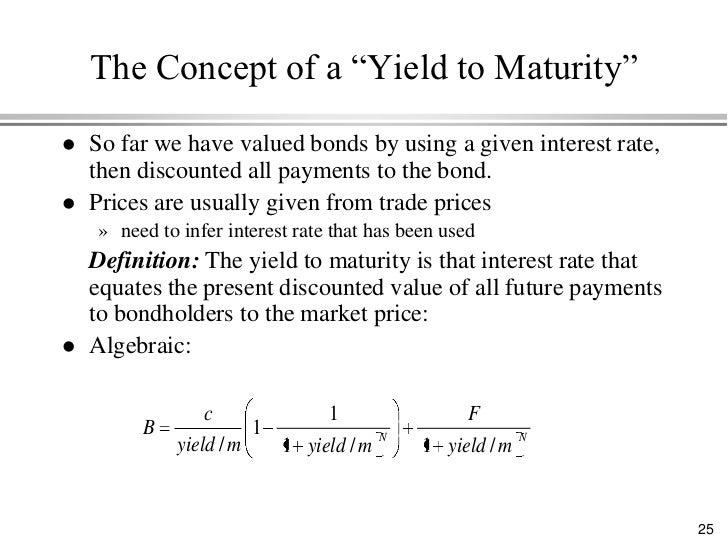

Calculating Yield to Maturity in Excel - Speck & Company There are two formulas to calculate yield to maturity depending on the bond. The yield to maturity formula for a zero-coupon bond: Yield to maturity = [ (Face Value / Current Value) (1 / time periods)] -1. The yield to maturity formula for a coupon bond: Bond Price = [ Coupon x (1 - (1 / (1 + YTM) n) / YTM) ] + [ Face Value x (1 / (1 + YTM) n ...

Bond Pricing - Formula, How to Calculate a Bond's Price For example, a 10% coupon on a $1000 par bond is redeemable each period. A bond may also come with no coupon. In this case, the bond is known as a zero-coupon bond. Zero-coupon bonds are typically priced lower than bonds with coupons. Bond Pricing: Principal/Par Value. Each bond must come with a par value that is repaid at maturity. Without the ...

Zero-Coupon Bond - Definition, How It Works, Formula Understanding Zero-Coupon Bonds. As a zero-coupon bond does not pay periodic coupons, the bond trades at a discount to its face value. To understand why, consider the time value of money.. The time value of money is a concept that illustrates that money is worth more now than an identical sum in the future - an investor would prefer to receive $100 today than $100 in one year.

Advantages and Risks of Zero Coupon Treasury Bonds Well, for one thing, zero-coupon bonds are bought for a fraction of face value. For example, a $20,000 bond can be purchased for far less than half of that amount.

Post a Comment for "38 present value of a zero coupon bond"