45 difference between yield to maturity and coupon rate

Weighted Average Maturity - (WAM) - Investopedia Weighted Average Maturity - WAM: Weighted average maturity (WAM) is the weighted average amount of time until the maturities on mortgages in a mortgage-backed security (MBS). This term is used ... Singapore Savings Bond 2022 - Interest Rate, Yield & How SSB Works 3 January 2022. 1 January 2032. 1.78%. Source: MAS. The average 10-year rate of returns for SSBs seems to be experiencing a steady increase, usually ranging from 1% to 3%, with the highest rates between 2% to 3% offered in 2019.

South Africa Government Bonds - Yields Curve The South Africa 10Y Government Bond has a 9.835% yield. 10 Years vs 2 Years bond spread is 419.5 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.75% (last modification in May 2022). The South Africa credit rating is BB-, according to Standard & Poor's agency. Current 5-Years Credit Default Swap quotation is ...

Difference between yield to maturity and coupon rate

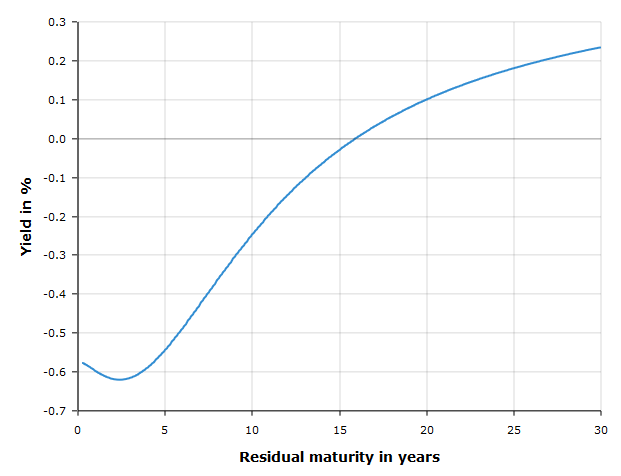

Monthly Or At Maturity? | Interest | Mozo Paid monthly. Paid at maturity. Interest will be paid gradually over the life of your term deposit. Interest is paid all at once when your term comes to an end. Generally comes with a slightly lower interest rate to offset the compounding effect. Will often come with a slightly higher interest rate. Switzerland Government Bonds - Yields Curve The Switzerland 10Y Government Bond has a 0.675% yield. 10 Years vs 2 Years bond spread is 81 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is -0.75% (last modification in January 2015). The Switzerland credit rating is AAA, according to Standard & Poor's agency. Created with Highcharts 10.1.0. Yield to Call - Meaning, Formula, Example and More | eFM This bond makes two coupon payments a year. So, the total annual coupon payment will be $1,400. Now, putting the values in the formula: YTC = ($1,400 + ($10,200 - $9,000 ) ÷ 5 ) ÷ ( ( $10,200 + $9,000 ) ÷ 2 ) = 5.4% Another way to calculate the YTC is to use the formula for YTM and make some adjustments to it.

Difference between yield to maturity and coupon rate. What Is a Zero Coupon Yield Curve? - Smart Capital Mind The zero coupon rate is the return, or yield, on a bond corresponding to a single cash payment at a particular time in the future. This would represent the return on an investment in a zero coupon bond with a particular time to maturity. The zero coupon yield curve shows in graphical form the rates of return on zero coupon bonds with different ... ETF Areas to Consider as Fed Hikes Rates Again in 2022 - Nasdaq The benchmark 10-year Treasury note yield surged to nearly 3.04% in afternoon trading on May 5, touching the highest mark since 2018. The 30-year Treasury bond yield also increased to roughly 3.126%. India Government Bonds - Yields Curve The India 10Y Government Bond has a 7.429% yield.. 10 Years vs 2 Years bond spread is 95.7 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 4.40% (last modification in May 2022).. The India credit rating is BBB-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 107.14 and implied probability of default is 1.79%. Zero Coupon Yield Curves Technical Documentation Bis However, there can be differences between the two. This difference, which can be positive or negative, is referred to as the swap spread . Euro Yield Curves - YCharts Bootstrapping spot rates or zero coupon interest rates works as follows. Suppose we are given two par rates, the par rate for one year (1.00%) and the par rate for two years (1.25%).

Malaysia Government Bonds - Yields Curve The Malaysia 10Y Government Bond has a 4.150% yield.. 10 Years vs 2 Years bond spread is 75.3 bp. Normal Convexity in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.00% (last modification in May 2022).. The Malaysia credit rating is A-, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 57.19 and implied probability of default is 0.95%. Bond Yield | Definition | Finance Strategists A bond's yield is a measure of its return. The yield is calculated using the bond's current market price (not its principal value) and its coupon rate. Subscribe to the Finance Strategists YouTube Channel ↗. 10-Year Treasury Constant Maturity Minus Federal Funds Rate Graph and download economic data for 10-Year Treasury Constant Maturity Minus Federal Funds Rate (T10YFF) from 1962-01-02 to 2022-05-26 about yield curve, spread, 10-year, maturity, federal, Treasury, interest rate, interest, rate, and USA. finance.wharton.upenn.edu › ~acmack › Chapter_05_appAppendix 5A The Term Structure of Interest Rates, Spot Rates ... Once we get the bond price, we use A.2 to calculate its yield to maturity. Because Equation A.1 employs two spot rates whereas only one appears in A.2, we can think of yield to maturity as some sort of average of the two spot rates.2 Using these spot rates, the yield to maturity of a two-year coupon bond whose coupon rate is $120 _____ 1 r ...

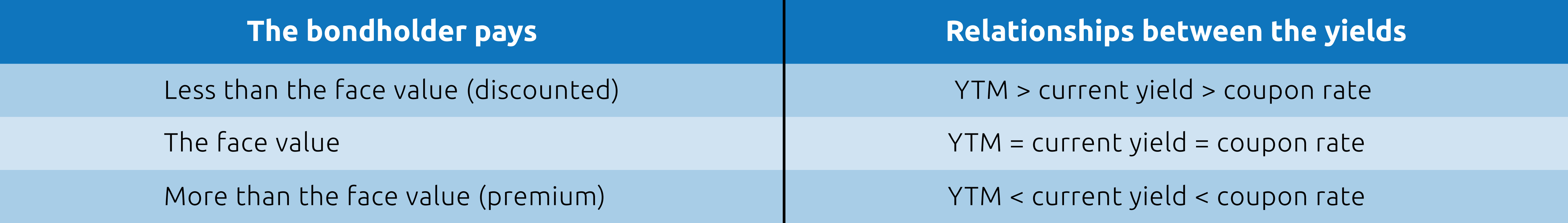

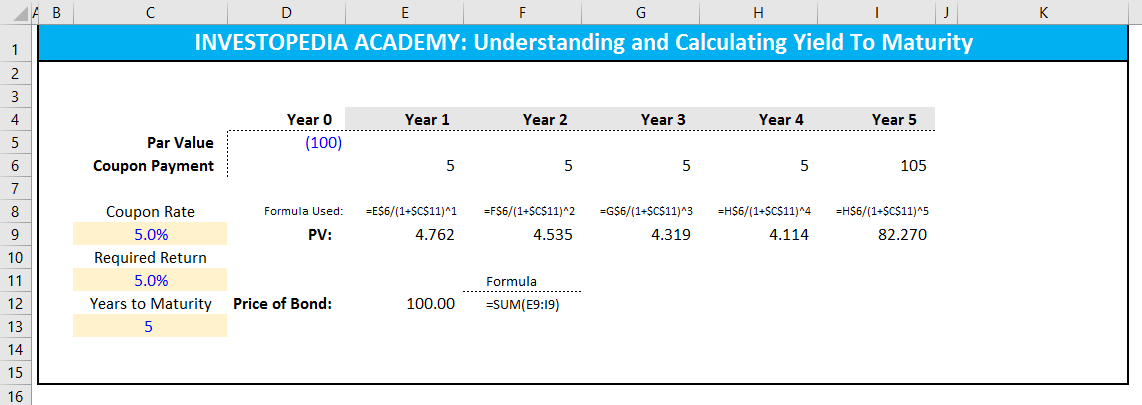

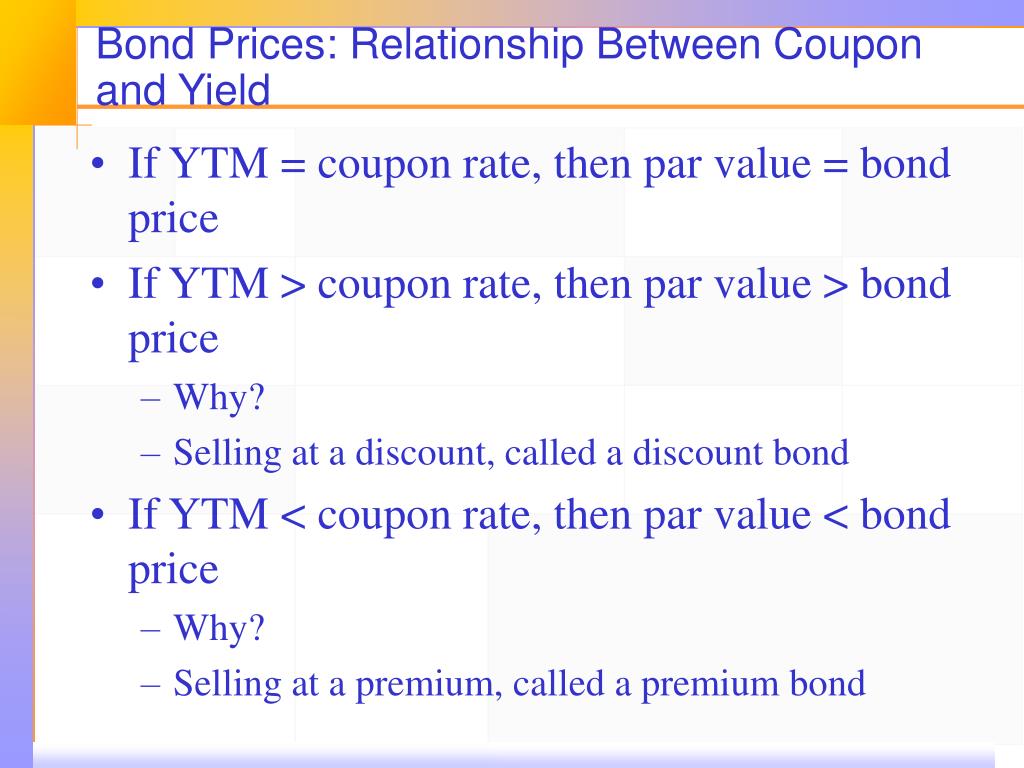

Yield to Maturity vs. Coupon Rate: What's the Difference? The yield to maturity is the estimated annual rate of return for a bond assuming that the investor holds the asset until its maturity date and reinvests the payments at the same rate. 1 The coupon... How Attractive are the Astrea 7 PE Bonds? (Indicative yield of 4.1%, 5 ... The bond coupon or the current yield to maturity is indicative during the issue. Most likely, when the bond starts trading, the yield to maturity will be much lower. This is because past Astrea bond issues have been so popular as the retail sees this like a safe bond but yielding more than 4%. How To Calculate Yield To Maturity Of Zero Coupon Bond In Excel The yield to maturity formula for a zero-coupon bond. A Zero Coupon Bond or a Deep Discount Bond is a bond that does not pay periodic coupon or interest. The exact same formula is used to calculate both YTM and YTC Yield to Call. For the bond is 15 and the bond will reach maturity in 7 years. Notice that we didnt need to make any adjustments to. How Long Does It Take for Series EE Bonds To Mature? The difference in maturity dates for these bonds results from the differing rates of interest built into each Series EE bond when it's issued. Bonds issued in 2022 come with a fixed rate for up to 30 years. Older bonds issued between 1997 and 2005 have a variable rate that changes twice a year.

Yield to Worst - Meaning, Importance, Calculation, and More Formula to calculate Yield to Maturity = / [ (FV + PV)/2] Here C = coupon or interest amount, FV = face value of the bond, PV = present value of the bond, and T = term of the bond. So, to calculate YTW, we change the t to the period when the issuer recalls the bond. Another formula to calculate YTW is: YTW = Risk-Free Rate plus Credit Risk Premium

Municipal Bonds Market Yields | FMSbonds.com Municipal Market Yields. The tables and charts below provide yield rates for AAA, AA, and A rated municipal bonds in 10, 20 and 30 year maturity ranges. These rates reflect the approximate yield to maturity that an investor can earn in today's tax-free municipal bond market as of 05/02/2022.

Money Market Accounts or CDs: Which Investment Is Better? Key Takeaways. An MMA is a better vehicle to use when you may have an immediate need for cash. A CD usually offers a higher yield than an MMA, but there are penalties if you take out your money ...

Treasury Yield Definition - Investopedia where C= coupon rate FV = face value PP = purchase price T = years to maturity The yield on a 10-year note with 3% coupon purchased at a premium for $10,300 and held to maturity is: Treasury Yield...

Short-Term TIPS ETFs: The 'Real' Risk-Free Asset (NYSEARCA:STIP) The first instance of this happening was on October 25, 2010, when the Treasury sold TIPS with a 4.5 year maturity and a .5% coupon rate at an auction price of $105.51. Thus, at issuance, the...

calculator.me › savings › zero-coupon-bondsZero Coupon Bond Value Calculator: Calculate Price, Yield to ... Here is an example calculation for the purchase price of a $1,000,000 face value bond with a 10 year duration and a 6% annual interest rate. 20. Calculating Yield to Maturity on a Zero-coupon Bond. YTM = (M/P) 1/n - 1. variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value; P ...

Are TIPS Worth Considering Now? | Charles Schwab The breakeven rate is the difference between the yield of a nominal Treasury and the yield of a TIPS with a similar maturity. TIPS yields tend to be lower than nominal Treasury yields because investors can benefit when inflation rises, as the principal values adjust higher; nominal Treasury principal values and coupon payments are fixed ...

Turkey Government Bonds - Yields Curve The Turkey 10Y Government Bond has a 21.670% yield.. 10 Years vs 2 Years bond spread is -333 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 14.00% (last modification in December 2021).. The Turkey credit rating is B+, according to Standard & Poor's agency.. Current 5-Years Credit Default Swap quotation is 713.65 and implied probability of default is 11.89%.

Post a Comment for "45 difference between yield to maturity and coupon rate"