39 present value of coupon bond

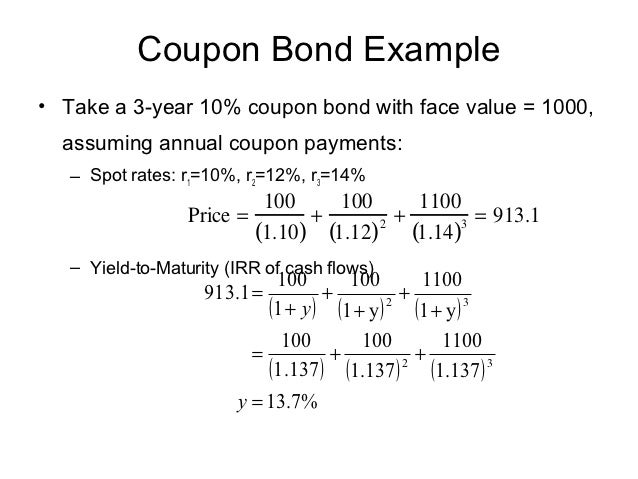

What is a Bond Valuation? | Learn More | Investment U In this example, the present value of coupon payments would be $399.27 and the present value of the par value is $680.58. This bond trades at a premium to its par value—rightfully so, since it has a higher interest rate than the current prevailing rate. How to Calculate the Price of Coupon Bond? - WallStreetMojo The present value is computed by discounting the cash flow using yield to maturity. Mathematically, it the price of a coupon bond is represented as follows, Coupon Bond = ∑i=1n [C/ (1+YTM)i + P/ (1+YTM)n] Coupon Bond = C * [1- (1+YTM)-n/YTM + P/ (1+YTM)n]

How to Calculate Present Value of a Bond - Pediaa.Com Calculate present value of a bond: Step 1: Calculate Present Value of the Interest Payments. Present value of the interest payments can be calculated using following formula where, C = Coupon rate of the bond F = Face value of the bond R = Market t = Number of time periods occurring until the maturity of the bond. Step 2: Calculate Present Value of the Face Value of the Bond

Present value of coupon bond

How to calculate the present value of a bond - AccountingTools The maturity date of the bond is in five years. The bond pays 6% at the end of each year. With this information, we can now compute the present value of the bond, as follows: Determine the interest being paid on the bond per year. In this case, the amount is $6,000, which is calculated as $100,000 multiplied by the 6% interest rate on the bond. Coupon Payment | Definition, Formula, Calculator & Example Coupon Payment Calculator Example Walmart Stores Inc. has 3 million, $1,000 par value bonds payable due on 15th August 2037. They carry a coupon rate of 6.5% while the payments are made semiannually. Its current yield is 4.63% while its yield to maturity is 3.92%. The coupon payment on each of these bonds is $32.5 [=$1,000 × 6.5% ÷ 2]. Bond Valuation Overview (With Formulas and Examples) To find the bond's present value, we add the present value of the coupon payments and the present value of the bond's face value. Value of bond = present value of coupon payments + present value of face value Value of bond = $92.93 + $888.49 Value of bond = $981.42. A natural question one would ask is, what does this tell me?

Present value of coupon bond. How to Figure Out the Present Value of a Bond - dummies Use the present value factors to calculate the present value of each amount in dollars. The present value of the bond is $100,000 x 0.65873 = $65,873. The present value of the interest payments is $7,000 x 3.10245 = $21,717, with rounding. Add the present value of the two cash flows to determine the total present value of the bond. Solved Calculate the Present Value of a zero-coupon bond | Chegg.com Find the duration of the zero-coupon bond. Question: Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. Valuing Bonds | Boundless Finance | | Course Hero The bond price can be summarized as the sum of the present value of the par value repaid at maturity and the present value of coupon payments. The present value of coupon payments is the present value of an annuity of coupon payments. The present value of an annuity is the value of a stream of payments, discounted by the interest rate to account for the payments being made at various moments in the future. Key Terms Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

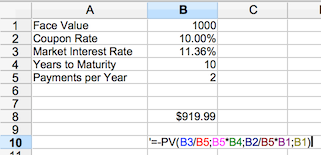

How to Calculate PV of a Different Bond Type With Excel The bond has a present value of $376.89. B. Bonds with Annuities Company 1 issues a bond with a principal of $1,000, an interest rate of 2.5% annually with maturity in 20 years and a discount rate... Bond Valuation - Present Value of a Bond, Par Value, Coupon Payments ... The Present Value of a Bond = The Present Value of the Coupon Payments ( an annuity) + The Present Value of the Par Value ( time value of money) Example Par Value = $ 1,000 Maturity Date is in 5 years Annual Coupon Payments of $100, which is 10% Market Interest rate of 8% The Present Value of the Coupon Payments ( an annuity) = $399.27 Coupon Bond - Guide, Examples, How Coupon Bonds Work If there is a high probability of default, investors may require a higher rate of return on the bond. Similar to the pricing of other types of bonds, the price of a coupon bond is determined by the present value formula. The formula is: Where: c = Coupon rate i = Interest rate n = number of payments Coupon Bond | Coupon Bond Price | Examples of Coupon Bond The yield to maturity is used to discount the future cash flows to present value. Mathematically, the coupon bond formula is represented as, Coupon Bond = C * [ (1- (1 + YTM))^ (-n))/ YTM ]+ [P/ (1 + YTM)^n] where, C = Coupon payment P= Par value YTM = Yield to maturity n = Number of periods until maturity Examples

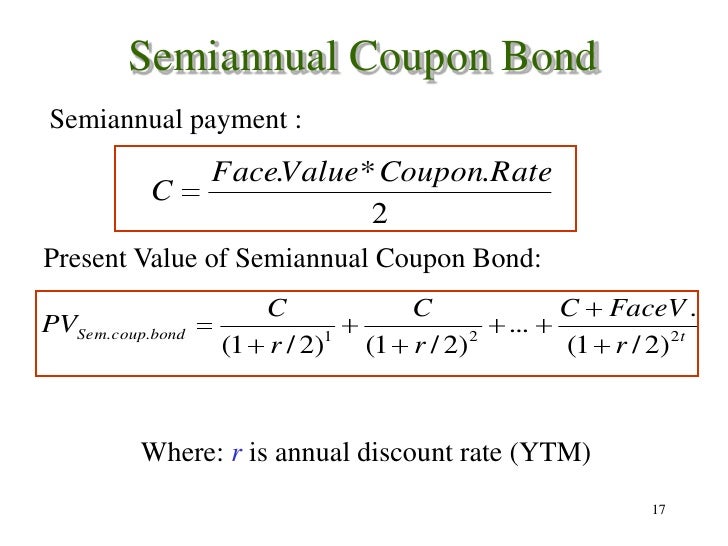

Calculating the Present Value of a 9% Bond in an 8% Market The present value of the bond in our example is $36,500 + $67,600 = $104,100. The bond's total present value of $104,100 should approximate the bond's market value. It is reasonable that a bond promising to pay 9% interest will sell for more than its face value when the market is expecting to earn only 8% interest. The value of a bond is the present value of its coupon payments plus ... We will write a custom Essay on The value of a bond is the present value of its coupon payments plus the present value of its par… specifically for you for only $16.05 $13/page. 805 certified writers online Zero Coupon Bond Calculator - What is the Market Value? So a 10 year zero coupon bond paying 10% interest with a $1000 face value would cost you $385.54 today. In the opposite direction, you can compute the yield to maturity of a zero coupon bond with a regular YTM calculator. Bond Valuation Definition - Investopedia Present value of semi-annual payments = 25 / (1.015) 1 + 25 / (1.015) 2 + 25 / (1.015) 3 + 25 / (1.015) 4 = 96.36 Present value of face value = 1000 / (1.015) 4 = 942.18 Therefore, the value of the...

Bond Present Value Calculator The calculator, uses the following formulas to compute the present value of a bond: Present Value Paid at Maturity = Face Value / (Market Rate/ 100) ^ Number Payments. Present Value of Interest Payments = Payment Value * (1 - (Market Rate / 100) ^ -Number Payments) / Number Payments) Present Value of Bond = Present Value Paid at Maturity + Present Value of Interest Payments

Coupon Bond Formula | Examples with Excel Template Coupon Bond = $25 * [1 - (1 + 4.5%/2)-16] + [$1000 / (1 + 4.5%/2) 16; Coupon Bond = $1,033; Therefore, the current market price of each coupon bond is $1,033, which means it is currently traded at a premium (current market price higher than par value). Explanation. The formula for coupon bond can be derived by using the following steps:

Coupon Rate Formula | Step by Step Calculation (with Examples) The par value of the bond is $1,000, and it is trading $950 in the market. Determine which statement is correct: Dave said that the coupon rate is 10.00% Harry said that the coupon rate is 10.53% Annual Coupon Payment Annual coupon payment = 4 * Quarterly coupon payment = 4 * $25 = $100

calculating the present value of a bond | StudyBlue calculating the present value of a bond. Get your original paper written from scratch starting at just $10 per page with a plagiarism report and free revisions included! 4. (calculating the present value of a bond) If a corporate bond with a face value of $1,000 has 24 years to go until it matures, has a coupon interest rate of 5.7% and a yield ...

Corporate Bond Valuation - Overview, How To Value And Calculate Yield How to Value a Corporate Bond (Probability Tree Method) A common way to visualize the valuation of corporate bonds is through a probability tree. Consider the following example of a corporate bond: 3-year maturity; $1,000 face value; 5% coupon rate ($50 coupon payments paid annually) 60 payout ratio ($600 default payout) 10 probability of default

Zero Coupon Bond Value - Formula (with Calculator) A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Solved c) Calculate the Present Value of a zero-coupon bond | Chegg.com Finance questions and answers. c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to maturity 6% pa and time to maturity equal to 10 years. Find the duration of the zero-coupon bond. an. Question: c) Calculate the Present Value of a zero-coupon bond with nominal value 1 million pounds and yield to ...

How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay for this bond if the discount rate is 7%.

Post a Comment for "39 present value of coupon bond"