40 coupon rate of bond

U.P. Power Corporation Limited 10.15% - Bond - ICICI Direct Coupon rate 10.15% Face Value 1,000,000. Maturity date 19-Jan-2024. Last Traded Price 1041800.0 . Last Traded Date 04-Oct-2022. Key Metrics. Nature of bond Secured ... Bonds issued by company Yield (%) Last Traded Price Face Value Time till maturity Last traded on; U.P. Power Corporation Ltd 10.15% Brickwork AA-(SO)/Stable: 8.79: Fixing of coupon rates - Nykredit Realkredit A/S Effective from 10 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing The new coupon rates will apply...

What Are Bonds and How Do They Work? Examples & FAQ Coupon Rate: The annual income the bondholder will receive on their bond. The annual coupon rate is calculated by interest rates. The coupon rate is set in the bond agreement, but it can vary...

Coupon rate of bond

U.S. Treasury Bond Overview - CME Group Time & Sales. Specs. Margins. Calendar. US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading. US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 3 days ago, on 7 Oct 2022 Frequency daily Description These yield curves are... › finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate

Coupon rate of bond. Why Senators Are Fighting to Help You to Buy More I Bonds Soon I Bonds Basics. I Bonds are issued by the U.S. Government. They carry a zero-coupon interest rate which is adjusted twice annually for inflation. The rate will be 9.62% through October 2022, at ... › terms › cCoupon Rate Definition - Investopedia May 28, 2022 · Coupon Rate: A coupon rate is the yield paid by a fixed-income security; a fixed-income security's coupon rate is simply just the annual coupon payments paid by the issuer relative to the bond's ... home.treasury.gov › data › treasury-coupon-issuesTreasury Coupon Issues and Corporate Bond Yield Curves Treasury Coupon Issues Learn about the Treasury Yield Curves for Nominal and Real Coupon Issues (TNC and TRC yield curves) and The Treasury Breakeven Inflation Curve (TBI curve). Corporate Bond Yield Curve Papers and Data Learn about the corporate bond yield curve, and how it relates to the Pension Protection Act, by downloading these papers. BONDS | BOND MARKET | PRICES | RATES | Markets Insider The nominal value is the price at which the bond is to be repaid. The coupon shows the interest that the respective bond yields. ... The credit terms for bonds, such as the rate of return, term ...

Treasury Bill Rates - NASDAQ - Datastore The Bank Discount rate is the rate at which a Bill is quoted in the secondary market and is based on the par value, amount of the discount and a 360-day year. The Coupon Equivalent, also called the Bond Equivalent, or the Investment Yield, is the bill`s yield based on the purchase price, discount, and a 365- or 366-day year. Corporate Bond Valuation - Overview, How To Value And Calculate Yield A common way to visualize the valuation of corporate bonds is through a probability tree. Consider the following example of a corporate bond: 3-year maturity $1,000 face value 5% coupon rate ($50 coupon payments paid annually) 60 payout ratio ($600 default payout) 10 probability of default 5% risk-adjusted discount rate United States Government Bonds - Yields Curve The United States 10Y Government Bond has a 3.888% yield. 10 Years vs 2 Years bond spread is -42.6 bp. Yield Curve is inverted in Long-Term vs Short-Term Maturities. Central Bank Rate is 3.25% (last modification in September 2022). The United States credit rating is AA+, according to Standard & Poor's agency. Treasury Bonds Rates - WealthTrust Securities Limited Depending on the yield and the coupon rate, the price (per 100 rupees) of a T-Bond, can either be more than Rs. 100 (premium) or below Rs. 100 (discount). While offering higher return than other fixed income investments, T-Bond investments can be liquidated instantly by way of the secondary market.

› ask › answersYield to Maturity vs. Coupon Rate: What's the Difference? May 20, 2022 · The annual coupon rate for IBM bond is thus $20 / $1,000 or 2%. Fixed-Rate and Market Value . While the coupon rate of a bond is fixed, the par or face value may change. No matter what price the ... en.wikipedia.org › wiki › Coupon_(finance)Coupon (finance) - Wikipedia In finance, a coupon is the interest payment received by a bondholder from the date of issuance until the date of maturity of a bond. Coupons are normally described in terms of the "coupon rate", which is calculated by adding the sum of coupons paid per year and dividing it by the bond's face value. For example, if a bond has a face value of ... Bonds- YTM, coupon rate, interest rate risk - BrainMass Coupon rate= 9.20% Face value= $1,000 Frequency = S Semi annual coupon payments Redemption value = $1,000 Price of the bond= $1,040.00 =104%*1000 Interest payment per year= $92.00 =9.2% x 1000 Interest payment per period= $46.00 =92/2 No of Periods =n= 20 =2x10 Yield= 8.60% (Using EXCEL Function RATE) =2x RATE (20,46,-1040,1000) Yield to Call Calculator | Calculating YTC | InvestingAnswers coupon rate. number of years to the call date. frequency of payments. call premium (if any) current price of the bond. Calculating Yield to Call Example. For example, you buy a bond with a $1,000 face value and an 8% coupon for $900. The bond pays interest twice a year and is callable in 5 years at 103% of face value. Using our YTC calculator ...

Difference Between Coupon Rate and Interest Rate The coupon rate is normally used in the bonds, which is an income to the holder after paying the rate on certain purchased items. Interest rate is a reduction to the borrower by paying back the amount he/she has borrowed. The coupon Rate ends according to the maturity period mentioned by the bondholder while issuing the bond.

NHAI Investment Trust to raise Rs 1,500 crore via issuance of bonds ... Retail and institutional investors will also be able to participate in the Rs 1500-crore bonds that are slated to be issued. Given the state of the market at this time, it is anticipated that these bonds will be offered to retail investors at a coupon rate of roughly 7 per cent.

10-year government bond yield by country 2022 | Statista As of October 6, 2022, the major economy with the highest yield on 10-year government bonds was Nigeria, with a yield of 13.42 percent.

10 Year Treasury Rate - YCharts Many analysts will use the 10 year yield as the "risk free" rate when valuing the markets or an individual security. Historically, the 10 Year treasury rate reached 15.84% in 1981 as the Fed raised benchmark rates in an effort to contain inflation. 10 Year Treasury Rate is at 3.89%, compared to 3.83% the previous market day and 1.58% last year.

Yield to Maturity vs. Holding Period Return - Investopedia The YTM, often stated as an annual percentage rate (APR), assumes that all coupon and principal payments are made on time. Many computations also account for reinvested dividends, but this is not a...

Indiabulls Housing Finance Ltd 9.0% bond yield, coupon rate ... - INDmoney Indiabulls Housing Finance Limited 10.1%. Last traded on 16 Mar, 2015. Coupon Rate. 10.1%. Face Value. ₹1 Lac. Time till maturity. 4 mo. Credit Rating.

Bonds - MunicipalBonds.com What are municipal bonds? The Key Benefit of Municipal Bonds: Tax-Free Interest; The 5 Basic Elements of Bond Investing; Two Types of Bonds: General Obligation vs. Revenue Bonds; Risks of Bond Investing; Understanding Bond Ratings; The Safety of Municipal Bonds; Default Rates of Municipal Bonds; Taxable-Equivalent Yield; Tax-Exemption from ...

How does a bond work? A simple (and informative) guide Original bond value: $1,000 x 5 percent = $50. Increased bond value: $1,250 x 4 percent=$50. How much the bond will change in value due to changes in interest rates will depend upon the remaining term of the loan. As a rule, bonds with a remaining maturity of more than 20 years will be more subject to interest rate swings.

United Kingdom Government Bonds - Yields Curve Last Update: 8 Oct 2022 20:15 GMT+0 The United Kingdom 10Y Government Bond has a 4.260% yield. 10 Years vs 2 Years bond spread is 19.6 bp. Yield Curve is flat in Long-Term vs Short-Term Maturities. Central Bank Rate is 2.25% (last modification in September 2022). The United Kingdom credit rating is AA, according to Standard & Poor's agency.

Treasury Inflation-Protected Securities | TIPS: Perfect investment for ... The Treasury should recognize this and raise the I Bond's fixed rate. I am going to suggest 0.3% to 0.5%. A 0.5% rate would put the fixed rate where it was in Fed's last tightening cycle from November 2018 through November 2019. At that time, in November 2018, the 10-year TIPS had a real yield of 1.1%, much lower than it is today.

consider a coupon bond that has a 900 par value and a coupon rate of 6 the bond is currently selling

High coupon rates, General election uncertainties shift PFAs attention ... In the light of rising interest rates and the uncertainty surrounding the impending general elections in 2023, Nigeria's largest investment body, Pension Fund Administrators (PFAs) are now increasing their holdings of corporate bonds. According to the most recent data from the National Pension Commission (PenCom), PFA investments in corporate ...

Fixing of coupon rates - Nykredit Realkredit A/S Effective from 11 October 2022, the coupon rates of floating-rate bonds issued by Nykredit Realkredit A/S will be adjusted. Bonds with quarterly interest rate fixing The new coupon rates will apply...

Current Rates | Edward Jones Zero Coupon Bonds These securities are derived from Government of Canada, Provincial Government, and Corporate bonds. The coupons are removed and sold as different securities. The zero coupon security carries the same backing as the original bond. Market and interest risks are greater with zero coupon securities than with the original bond.

CLI maiden bond offering successful | The Manila Times The CLI bonds will be issued in three tenors; Series A with a maturity of 3.5 years and a coupon rate of 6.4222 percent; Series B with a maturity of 5.5 years and a coupon rate of 6.9884 percent; and Series C with a maturity of seven years and a coupon rate of 7.3649 percent.

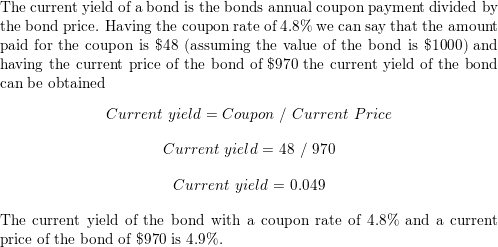

› ask › answersHow Can I Calculate a Bond's Coupon Rate in Excel? - Investopedia Jul 28, 2022 · A bond's coupon rate is simply the rate of interest it pays each year, expressed as a percentage of the bond's par value. (It's called the coupon rate because, in days of yore, investors actually ...

What Are Treasury Securities and How Do They Work? - TheStreet Treasury bills (T-bills): T-bills mature in 1 year or less and do not pay an interest rate, known in the bond world as the coupon rate. Thus, Treasury bills are also known as zero-coupon bonds.

What Is the Bond Market? | Northwestern Mutual Bonds are also often called debt securities or debt instruments. In exchange for your investment, you receive regular interest payments from the bond issuer (known as coupon payments). How much interest depends on the bond's coupon rate, which is established at the time that the bond is issued.

› ask › answersBond Coupon Interest Rate: How It Affects Price - Investopedia Dec 18, 2021 · For instance, a bond with a $1,000 face value and a 5% coupon rate is going to pay $50 in interest, even if the bond price climbs to $2,000, or conversely drops to $500. But if a bond's coupon ...

› finance › coupon-rateCoupon Rate Calculator | Bond Coupon Jul 15, 2022 · For a plain-vanilla bond, the coupon rate of the bond does not change with the market interest rates - it is fixed when the bond is issued. However, bonds issued in a high-interest rate environment are more likely to have a higher coupon rate. Even when the interest rate goes down, the coupon rate

US Treasury Zero-Coupon Yield Curve - NASDAQ US Treasury Zero-Coupon Yield Curve From the data product: US Federal Reserve Data Releases (60,778 datasets) Refreshed 3 days ago, on 7 Oct 2022 Frequency daily Description These yield curves are...

U.S. Treasury Bond Overview - CME Group Time & Sales. Specs. Margins. Calendar. US Treasury Bond futures and options are deeply liquid and efficient tools for hedging interest rate risk, potentially enhancing income, adjusting portfolio duration, interest rate speculation and spread trading.

/DurationandConvexitytoMeasureBondRisk2-0429456c85984ad3b220cd23a760cda5.png)

:max_bytes(150000):strip_icc()/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

/dotdash_INV-final-How-Can-I-Calculate-a-Bonds-Coupon-Rate-in-Excel-June-2021-01-8ff43b6e77a4475fb98d82707a90fae0.jpg)

Post a Comment for "40 coupon rate of bond"