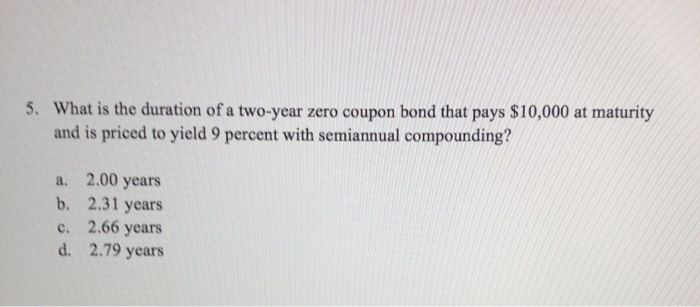

40 duration zero coupon bond

Zero Coupon Bond | Investor.gov The maturity dates on zero coupon bonds are usually long-term—many don't mature for ten, fifteen, or more years. These long-term maturity dates allow an investor to plan for a long-range goal, such as paying for a child's college education. With the deep discount, an investor can put up a small amount of money that can grow over many years. Duration - NYU Stern For zero-coupon bonds, there is a simple formula relating the zero price to the zero rate. •We use this price-rate formula to get a formula for dollar duration.

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years. Divide the $1,000 by $500 gives us 2. Raise 2 to the 1/30th power and you get 1.02329. Subtract 1, and you have 0.02329, which is 2.3239%. Advantages of Zero-coupon Bonds Most bonds typically pay out a coupon every six months.

Duration zero coupon bond

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ... 4 Measuring Interest-Rate Risk: Duration - FIU Faculty Websites A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon ... Macaulay's Duration | Formula | Example - XPLAIND.com Bond A: $1,000 face value coupon bond with 4 and half years till maturity. Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value.

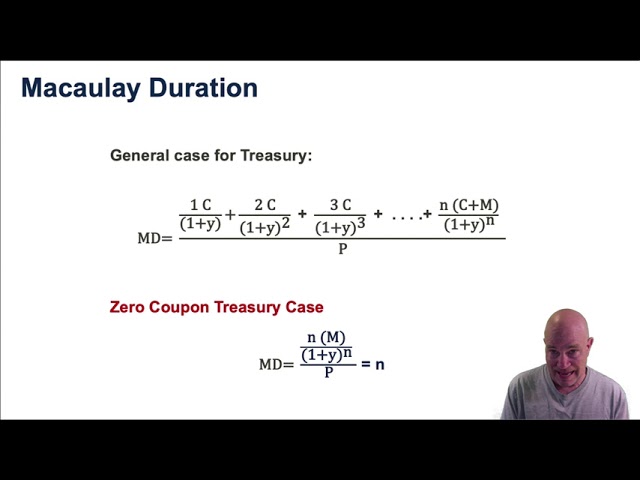

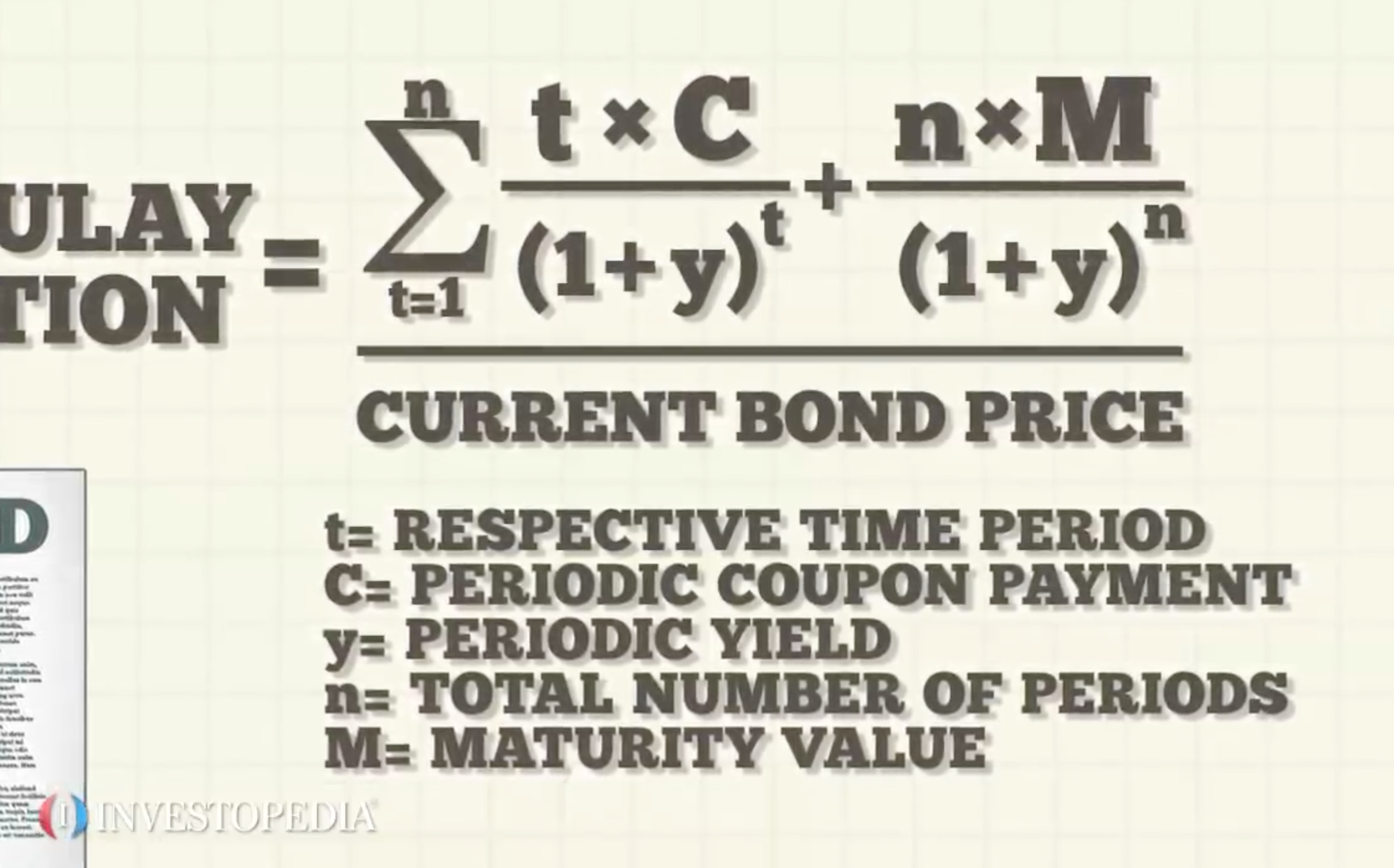

Duration zero coupon bond. Zero-Coupon Bond - Definition, How It Works, Formula John is looking to purchase a zero-coupon bond with a face value of $1,000 and 5 years to maturity. The interest rate on the bond is 5% compounded annually. What price will John pay for the bond today? Price of bond = $1,000 / (1+0.05) 5 = $783.53 The price that John will pay for the bond today is $783.53. Example 2: Semi-annual Compounding Bond Duration Calculator - Macaulay and Modified Duration - DQYDJ From the series, you can see that a zero coupon bond has a duration equal to it's time to maturity - it only pays out at maturity. Example: Compute the Macaulay Duration for a Bond Let's compute the Macaulay duration for a bond with the following stats: Par Value: $1000 Coupon: 5% Current Trading Price: $960.27 Yield to Maturity: 6.5% How to Calculate a Zero Coupon Bond Price - Double Entry Bookkeeping The zero coupon bond price is calculated as follows: n = 3 i = 7% FV = Face value of the bond = 1,000 Zero coupon bond price = FV / (1 + i) n Zero coupon bond price = 1,000 / (1 + 7%) 3 Zero coupon bond price = 816.30 (rounded to 816) The present value of the cash flow from the bond is 816, this is what the investor should be prepared to pay ... duration of zero coupon bonds | Forum | Bionic Turtle The Macaulay duration of a zero-coupon bond equals its maturity, such that the Mac duration of a zero-coupon bond must be monotonically increasing, and. DV01 = Price * Mod duration /10000, where in the case of a zero coupon bond: Price is a decreasing function of maturity (i.e., a zero is acutely "pulled to par"), but Mod duration is an ...

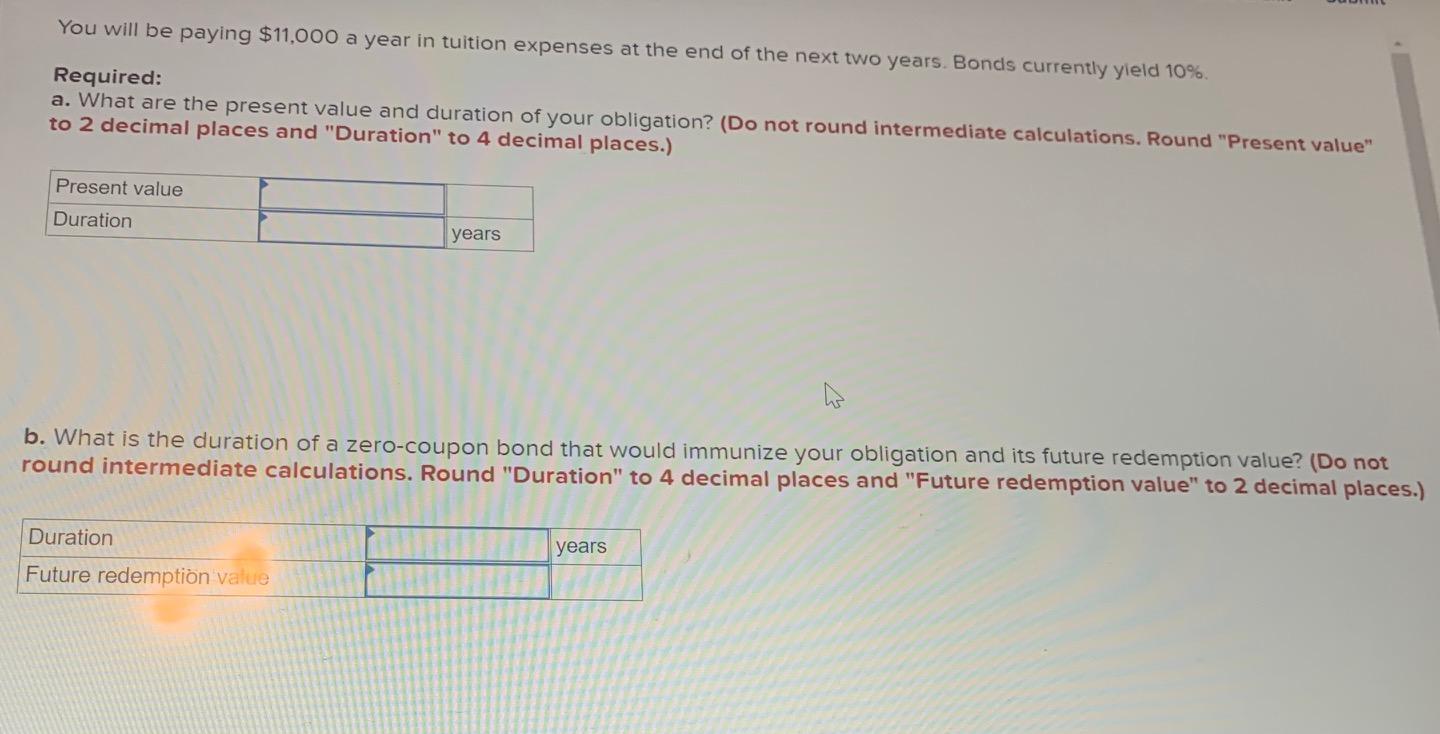

dqydj.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator – What is the Market Price? - DQYDJ Duration of a bond is a length of time representing how sensitive a bond is to changes in interest rates. Since zero coupon bonds have an equal duration and maturity, interest rate changes have more effect on zero coupon bonds than regular bonds maturity at the same time. (Whether that's good or bad is up to you!) en.wikipedia.org › wiki › Bond_valuationBond valuation - Wikipedia Therefore, (2) some multiple (or fraction) of zero-coupon bonds, each corresponding to the bond's coupon dates, can be specified so as to produce identical cash flows to the bond. Thus (3) the bond price today must be equal to the sum of each of its cash flows discounted at the discount rate implied by the value of the corresponding ZCB. Understanding Duration | BlackRock rates, duration allows for the effective comparison of bonds with different maturities and coupon rates. For example, a 5-year zero coupon bond may be more sensitive to interest rate changes than a 7-year bond with a 6% coupon. By comparing the bonds' durations, you may be able to anticipate the degree of Zero Coupon Bond Calculator - MiniWebtool The zero-coupon bond value calculation formula is as follows: Zero coupon bond value = F / (1 + r) t. Where: F = face value of bond. r = rate or yield. t = time to maturity.

Bond Duration | Formula | Excel | Example - XPLAIND.com Example. On 14 November 2017, you added the three bonds to your company's investment portfolios: (a) a $1,000 zero-coupon bond yielding 5.1% to maturity which is 31 December 2020, (b) a $100 face-value 6% semi-annual bond maturing on 30 June 2023 and yielding 4.8% and (c) a $1,000 face value 5.5% semi-annual bond maturing on 30 June 2023 and ... Duration and Zero Coupon Bonds - YouTube Oct 2, 2020 ... Examples of Macaulay duration are given for zero coupon bonds. Zero Coupon Bond Modified Duration Formula - Bionic Turtle We barely need a calculator to find the modified duration of this 3-year, zero-coupon bond. Its Macaulay duration is 3.0 years such that its modified duration is 2.941 = 3.0/ (1+0.04/2) under semi-annually compounded yield of 4.0%. Zero-Coupon Bonds: Characteristics and Calculation Example In our illustrative scenario, let's say that you're considering purchasing a zero-coupon bond with the following assumptions. Model Assumptions Face Value (FV) = $1,000 Number of Years to Maturity = 10 Years Compounding Frequency = 2 (Semi-Annual) Yield-to-Maturity (YTM) = 3.0%

Zero Coupon Bond Value - Formula (with Calculator) - finance formulas A 5 year zero coupon bond is issued with a face value of $100 and a rate of 6%. Looking at the formula, $100 would be F, 6% would be r, and t would be 5 years. After solving the equation, the original price or value would be $74.73. After 5 years, the bond could then be redeemed for the $100 face value.

Understanding the Relationship Between Coupon Rates and Duration For example, if I purchase a zero-coupon bond on its issue date the bond will have a duration of 30 years - no cash flow until the bond matures. If I purchased a bond with a 6% coupon rate, duration would be significantly less than 30 years because I'm receiving semi-annual bond interest until the bond matures.

Coupon Bond Vs. Zero Coupon Bond: What's the Difference? - Investopedia Zero-coupon bonds may also appeal to investors looking to pass on wealth to their heirs. If a bond selling for $2,000 is received as a gift, it only uses $2,000 of the yearly gift tax...

Zero-coupon bond - Wikipedia A zero coupon bond always has a duration equal to its maturity, and a coupon bond always has a lower duration. Strip bonds are normally available from investment dealers maturing at terms up to 30 years. For some Canadian bonds, the maturity may be over 90 years. [citation needed]

› ask › answersThe Macaulay Duration of a Zero-Coupon Bond in Excel Aug 29, 2022 · The Macaulay duration of a zero-coupon bond is equal to the time to maturity of the bond. Simply put, it is a type of fixed-income security that does not pay interest on the principal amount.

monevator.com › bond-durationBond duration: how it works and how you can use it - Monevator Oct 25, 2022 · What is bond duration? Bond duration expresses a bond’s vulnerability to interest rate risk. The larger the bond duration number, the more reactive a bond’s price is to interest rate changes, as the bond’s yield adjusts to reflect those changes. For example, if a bond’s duration number is 11, then it:

Prove that the duration of a bond without a coupon is equal to its ... Nov 8, 2019 ... Duration is in fact related to maturity weighted cash flows as you mention, but in the case of no coupon payments it is obtained in an easier ...

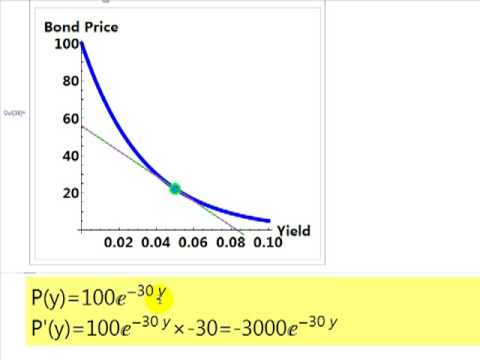

Bond Pricing Mathematical Derivation of Duration for. Zero Coupon Bond (1/2). • We can easily derive the duration from the bond price formula by differentiating it.

nerdcounter.com › zero-coupon-bond-calculatorZero Coupon Bond Calculator - Nerd Counter How to Calculate the Price of Zero Coupon Bond? The particular formula that is used for calculating zero coupon bond price is given below: P (1+r)t; Examples: Now come to a zero coupon bond example, if the face value is $2000 and the interest rate is 20%, we will calculate the price of a zero coupon bond that matures in 10 years.

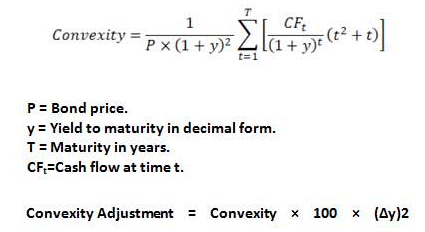

› convexity-of-a-bondConvexity of a Bond | Formula | Duration | Calculation The duration of the zero-coupon bond which is equal to its maturity (as there is only one cash flow) and hence its convexity is very high While the duration of the zero-coupon bond Zero-coupon Bond In contrast to a typical coupon-bearing bond, a zero-coupon bond (also known as a Pure Discount Bond or Accrual Bond) is a bond that is issued at a ...

Zero Coupon Bond - (Definition, Formula, Examples, Calculations) Cube Bank intends to subscribe to a 10-year this Bond having a face value of $1000 per bond. The Yield to Maturity is given as 8%. Accordingly, Zero-Coupon Bond Value = [$1000/ (1+0.08)^10] = $463.19 Thus, the Present Value of Zero Coupon Bond with a Yield to maturity of 8% and maturing in 10 years is $463.19.

What is the duration of a zero coupon bond? - Quora Mar 12, 2015 ... Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount ...

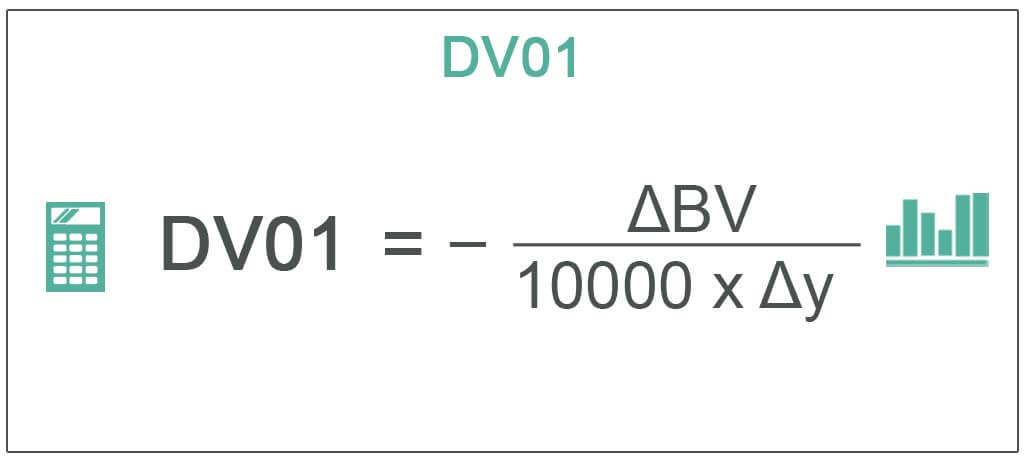

Dollar Duration - Overview, Bond Risks, and Formulas The formula for calculating dollar duration is: Dollar Duration = DUR x (∆ i/1+ i) x P Alternatively, if the change in the value of the bond and the yield is known, another formula can be used: DV01 = - (ΔBV/10000 * Δy) Where: ΔBV = Change in the value of a bond Δy = Change in yield Factor of Inaccuracy in Dollar Duration

Bond duration - Wikipedia For a standard bond, the Macaulay duration will be between 0 and the maturity of the bond. It is equal to the maturity if and only if the bond is a zero-coupon bond . Modified duration, on the other hand, is a mathematical derivative (rate of change) of price and measures the percentage rate of change of price with respect to yield.

What are Zero-Coupon Bonds? (Definition, Formula, Example, Advantages ... The price of zero-coupon bonds is calculated using the formula given below: See also How to Buy Clouthub Stocks? (FAQs) Price = M / (1 + r) ^ n, where M = maturity value of the bond. (In other words, the face value of the bond) R = required rate of return (or interest rate) N = number of years till maturity

How to Calculate Bond Duration - wikiHow Use the following steps to calculate bond duration. Part 1 Gathering Your Variables 1 Find the price of the bond. The first variable you will need is the bond's current market price. This should be available on a brokerage trading platform or on a market news website like the Wall Street Journal or Bloomberg.

Bond A is zero-coupon bond paying 100 one year from now. Bond B is a zero-coupon bond paying100 two years from now. Bond C is a 10% coupon bond that pays $10 one year from now and $10 plus the $100 ...

› terms › mWhat Is the Macaulay Duration? - Investopedia Sep 29, 2022 · Macaulay Duration: The Macaulay duration is the weighted average term to maturity of the cash flows from a bond. The weight of each cash flow is determined by dividing the present value of the ...

What is the duration of a zero coupon bond? - Quora Zero coupon bond can be of any duration , can be from one year to 10 years. It is ordinarily from 3 to 5 years. Zero coupon bonds are issued at a discount with par value paid on redemption, sometimes with a nominal premium.

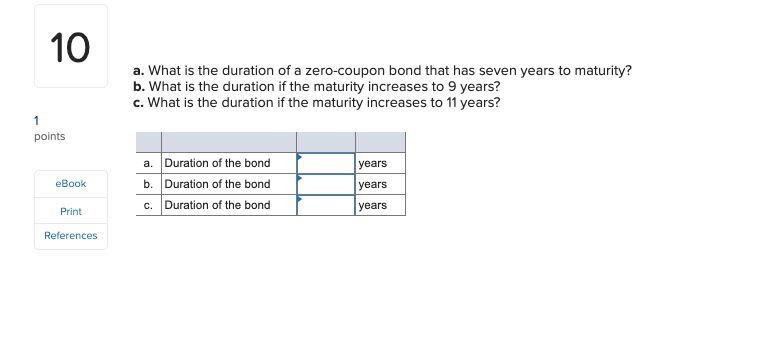

What is the duration of a zero-coupon bond that has eight years ... - Quora The duration of a zero-coupon bond is by definition equal to its maturity, so an 8-year zero has a duration of 8 years. If the maturity increases to 10 years, then so does the duration. 1 Kyle Taylor Founder at The Penny Hoarder (2010-present) Updated Wed Promoted Should you leave more than $1,000 in a checking account? You've done it.

Macaulay's Duration | Formula | Example - XPLAIND.com Bond A: $1,000 face value coupon bond with 4 and half years till maturity. Duration of Bond A is 4.5, i.e. the maturity period (in years) of the zero-coupon bond. Duration of Bond B is calculated by first finding the present value of each of the annual coupons and maturity value.

4 Measuring Interest-Rate Risk: Duration - FIU Faculty Websites A long-term discount bond with ten years to maturity, a so-called zero-coupon bond, makes all of its payments at the end of the ten years, whereas a 10% coupon ...

The One-Minute Guide to Zero Coupon Bonds | FINRA.org Zeros, as they are sometimes called, are bonds that pay no coupon or interest payment. will likely fall. Instead of getting interest payments, with a zero you buy the bond at a discount from the face value of the bond, and are paid the face amount when the bond matures. For example, you might pay $3,500 to purchase a 20-year zero-coupon bond ...

Post a Comment for "40 duration zero coupon bond"